Not known Factual Statements About Clark Wealth Partners

Table of ContentsThe Best Guide To Clark Wealth PartnersAn Unbiased View of Clark Wealth PartnersExcitement About Clark Wealth PartnersThe Of Clark Wealth PartnersLittle Known Facts About Clark Wealth Partners.Some Known Questions About Clark Wealth Partners.Clark Wealth Partners Fundamentals ExplainedThe Greatest Guide To Clark Wealth Partners

Typical factors to consider a financial consultant are: If your monetary circumstance has actually become more complex, or you lack confidence in your money-managing skills. Conserving or browsing major life occasions like marriage, divorce, kids, inheritance, or work change that may dramatically affect your economic situation. Navigating the change from conserving for retirement to maintaining riches throughout retirement and exactly how to create a strong retirement income strategy.New innovation has led to even more thorough automated monetary devices, like robo-advisors. It depends on you to investigate and identify the appropriate fit - https://www.quora.com/profile/Blanca-Rush. Inevitably, a good economic advisor needs to be as conscious of your investments as they are with their very own, staying clear of excessive charges, saving money on tax obligations, and being as clear as possible regarding your gains and losses

The Ultimate Guide To Clark Wealth Partners

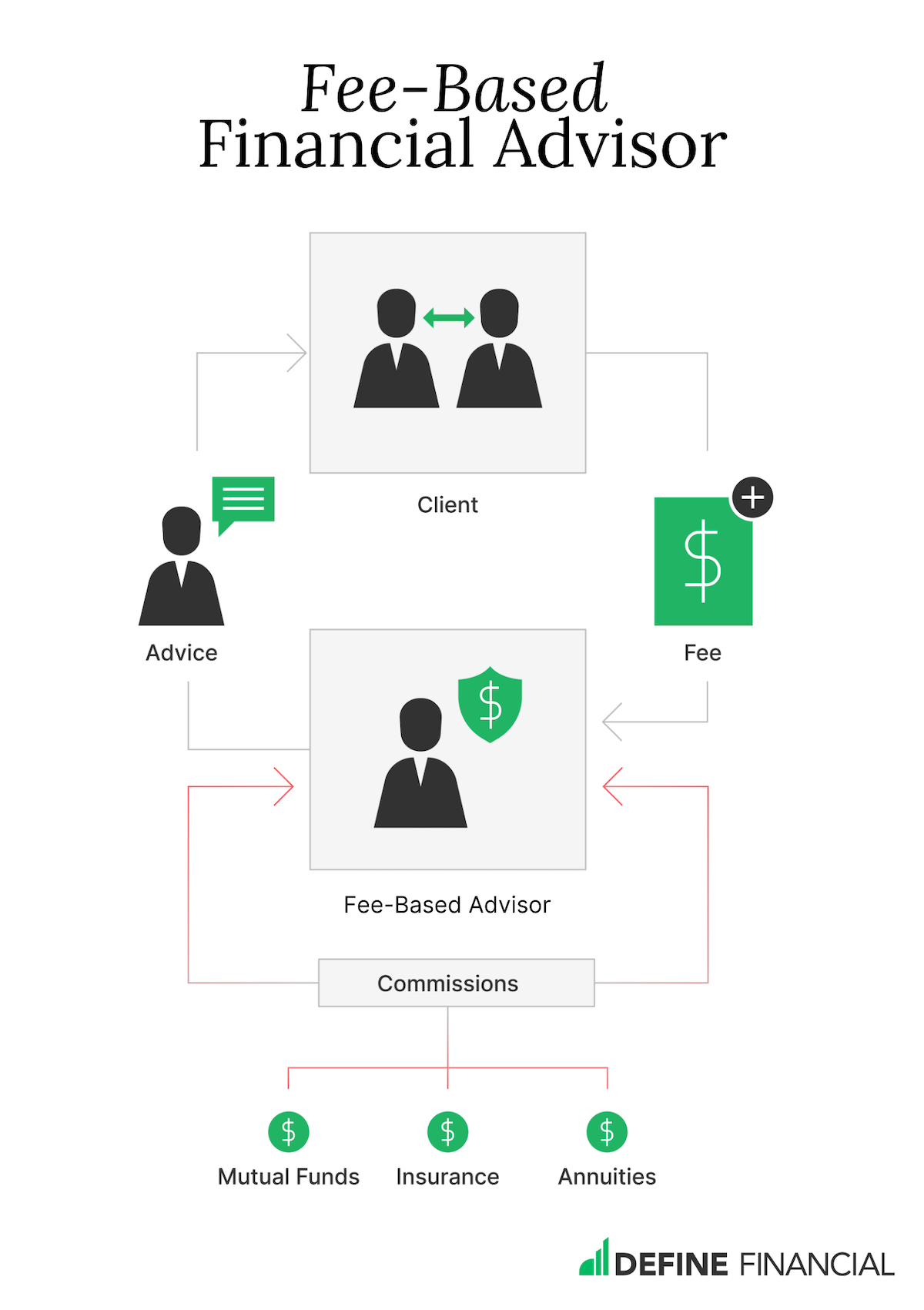

Gaining a payment on product referrals doesn't necessarily indicate your fee-based expert antagonizes your ideal passions. They may be more inclined to suggest items and services on which they make a commission, which may or may not be in your finest passion. A fiduciary is legitimately bound to place their client's interests.

This typical permits them to make referrals for financial investments and solutions as long as they suit their client's objectives, danger resistance, and monetary scenario. On the various other hand, fiduciary consultants are legitimately obligated to act in their customer's best passion instead than their very own.

The Only Guide for Clark Wealth Partners

ExperienceTessa reported on all things investing deep-diving right into intricate monetary subjects, clarifying lesser-known investment methods, and discovering ways readers can function the system to their benefit. As a personal finance professional in her 20s, Tessa is really aware of the impacts time and uncertainty have on your investment choices.

It was a targeted advertisement, and it functioned. Find out more Check out less.

Clark Wealth Partners Can Be Fun For Anyone

There's no single route to turning into one, with some individuals beginning in financial or insurance, while others start in accounting. 1Most monetary planners start with a bachelor's degree in finance, business economics, audit, business, or a relevant subject. A four-year level offers a strong foundation for occupations in investments, budgeting, and client solutions.

Not known Factual Statements About Clark Wealth Partners

Common instances include the FINRA Series 7 and Collection 65 exams for securities, or a state-issued insurance coverage permit for selling life or medical insurance. While qualifications may not be legally needed for all preparing functions, companies and customers commonly see them as a standard of expertise. We consider optional credentials in the following section.

The majority of monetary planners have 1-3 years of experience and knowledge with monetary products, conformity criteria, and straight client communication. A solid educational background is essential, yet experience demonstrates the ability to use concept in real-world settings. Some programs integrate both, enabling you to complete coursework while making supervised hours through internships and practicums.

Some Ideas on Clark Wealth Partners You Should Know

Lots of go into the area after functioning in financial, bookkeeping, or insurance, and the shift needs determination, networking, and commonly innovative credentials. Early years can bring lengthy hours, pressure to develop a customer base, and the requirement to consistently verify your competence. Still, the career uses strong long-term potential. Financial coordinators take pleasure in the chance to work carefully with customers, overview essential life decisions, and often accomplish adaptability in timetables or self-employment.

Wealth managers can increase their incomes with commissions, asset fees, and efficiency rewards. Economic managers manage a group of economic planners and consultants, Continue establishing departmental method, handling conformity, budgeting, and directing interior operations. They spent less time on the client-facing side of the sector. Almost all economic managers hold a bachelor's level, and numerous have an MBA or similar academic degree.

The Only Guide to Clark Wealth Partners

Optional certifications, such as the CFP, typically need added coursework and screening, which can expand the timeline by a pair of years. According to the Bureau of Labor Data, personal economic advisors gain a typical yearly yearly salary of $102,140, with leading income earners earning over $239,000.

In various other provinces, there are guidelines that require them to meet specific requirements to make use of the financial expert or monetary planner titles (financial company st louis). What sets some economic experts apart from others are education and learning, training, experience and credentials. There are many designations for financial advisors. For monetary planners, there are 3 common designations: Certified, Individual and Registered Financial Planner.

An Unbiased View of Clark Wealth Partners

Those on wage might have a reward to promote the products and services their companies provide. Where to find an economic advisor will certainly depend upon the kind of advice you require. These institutions have team that might aid you recognize and purchase certain kinds of investments. For instance, term down payments, ensured investment certifications (GICs) and shared funds.